year end accounts deadline

You should review for accuracy and advise Division Accounting of any needed corrections as soon as possible. Process your year end.

Fiscal Year Fy Definition And Importance Smartasset

For some transactions if your clients money is already invested within one of their tax wrappers cash accounts these transactions could complete after the deadlines below.

:max_bytes(150000):strip_icc()/ScreenShot2021-09-18at11.10.03AM-241ecfcb218d46bdbb4b16a285992b69.png)

. Remember these year-end retirement account deadlines. 22 March 2022 by 500pm client payment on 5 April 2022 New Income TRIO requests to be paid in 20212022 tax year. Deadline to submit all 2019 activity to post in 2019.

Full withdrawal from crystallised funds. FY21 invoices submitted by 5pm Thursday 617 will be posted to the GL by COB Thursday 624. Any 2019 revenues andor expenses submitted after Jan.

13 working days prior to payment. Year End Procurement Accounts Payable and PCard Deadlines. However theres an option to pay the renewal registrations quarterly which is due 20 days after the close of the quarter April 20 July 20 and October 20.

If your work involves acquiring andor paying for goods and services or using a PCard please familiarize yourself with the following dates for the 20192020 fiscal year. 31 2020 will be reflected in your 2020 budget. Reporting questions Contact UIS helpdesk at 6-2001 to open a ticket.

For most businesses this will be the same as their calendar year. Each year finance professionals bury their heads in the books to prepare their end-of-year accounts statements and financial reporting. What You Need to Send.

Now you can process your year end and make your final submission for the 202021 tax year. You must send your application to us before your normal filing deadline. However many people contribute to 401k plans via payroll withholding and.

The following deadlines are the dates which give you the utmost assurance that payments will be processed in time for tax year end. It should include a full explanation of why you need the extension. Remember your employees need to receive them by 31 May.

Using your payroll software make sure you check your processing date. Accounts Payable AP including Non-employee reimbursements Initial AP Cut-off. So if your companys financial year-end is 30th June you would need to complete your accounts by 30th June of the following year.

4 rows After the end of its financial year your private limited company must prepare. 164 Deadline for delivering and publishing partnership accounts. Deposits to your 401k plan are typically due by the end of the calendar year.

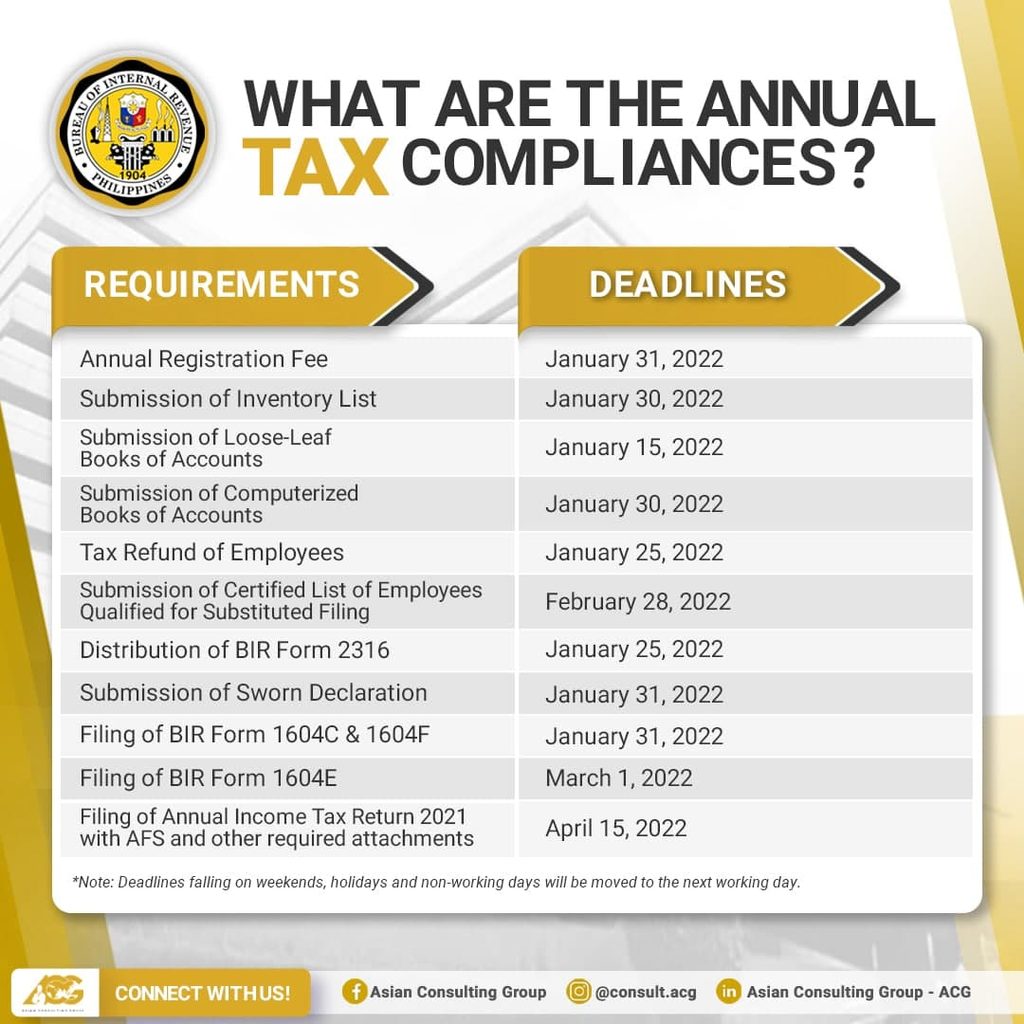

You must prepare the partnership accounts within a period of 9 months after the end of the financial year. 15 March 2022 by 500pm. Deadline of Annual Payment of Business Registrations Renewal is January 20.

Meet the 401k Contribution Deadline. 22 March 2022 by 500pm client payment on 5 April 2022 Amendments to existing Income TRIO instructions. 24 rows Anticipated expenses will be extracted from Concur for year-end reporting purposes.

This needs to be set for 5 April. Published November 18 2021. The time allowed for delivering accounts is 9 months from the accounting reference date.

Under the temporary measures the company will have received an automatic 3-month extension resulting in a deadline of 30 June 2021. Do note that this doesnt apply if you pay your VAT monthly or quarterly as the deadline will then fall one month and seven days after the end of each VAT period. Thursday 617 at 5pm.

Deadline to submit 2021 activity. Heres how to maximize the value of your retirement accounts before the end of the year. Data available to Tubs on Friday morning 625 in HDW.

UBCs fiscal year end is March 31 but the deadlines for some financial activities are as early as December. Year End Accounts VAT HMRC If your company is VAT-registered your VAT return will likely be due around the same time as your company year-end. Division Accounting will provide a first draft of the 2021 Year-End Financial Reports.

Closing Deadlines and Submission Information. Once this step is complete you can produce your P60s. Contact Division Accounting ASAP to discuss edits or questions.

The end of the fiscal year is a critical time for finance teams. Its estimated that the average accounting team takes 25 days to complete an annual close. 2021 Year-End Deadlines 3353 The end of the year is approaching and that means many will be finalizing various transactions such as contributions withdrawals and investment changes to your Virginia529 account.

Tax-free cash and income. You can apply for more time to file if something has happened that is out of your control and you cannot file your company accounts on time. A public company has an ARD of 30 September 2020.

10-14 2020 Division Accounting will provide final draft Year-End 2019 Financial Reports. Friday January 21 2022. The deadline for completing accounts year-end is usually 12 months after your companys financial year-end.

This will include December activity recorded to-date. Their deadline for filing accounts would usually be 31 March 2021. We will not issue you a late filing penalty if.

For existing companies it will be the anniversary of the day after the previous financial year ended. The deadline to process PCard transactions journals accounting adjustments travel requisitions and PAAs is June 15 2020 so that Sponsored Projects has sufficient time to process the final invoice after July 10 2020 when the classified.

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

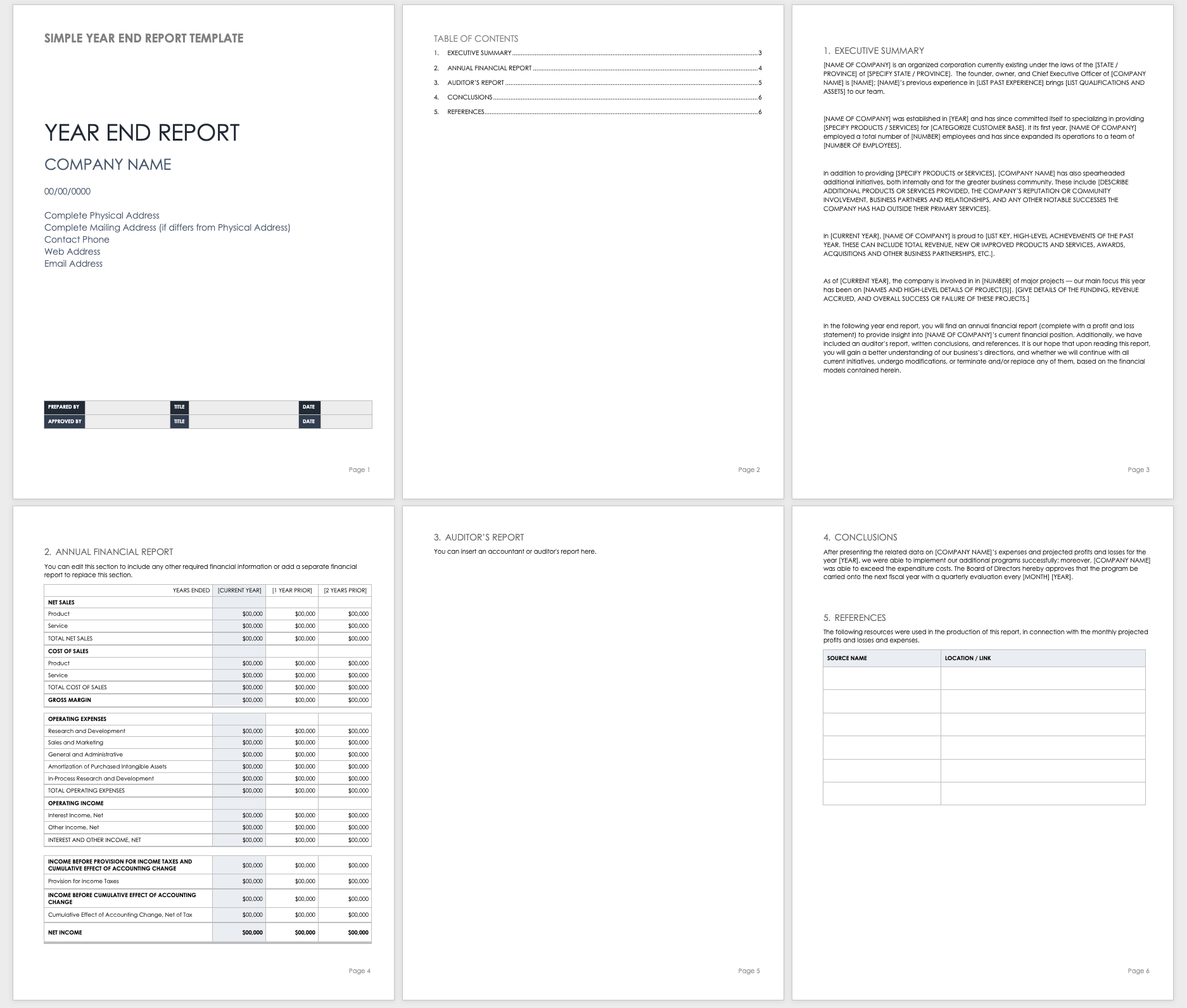

Free Year End Report Templates Smartsheet

When And How To File Your Annual Accounts With Companies House Companies House

Ask The Tax Whiz What Are The Year End Requirements For Taxpayers

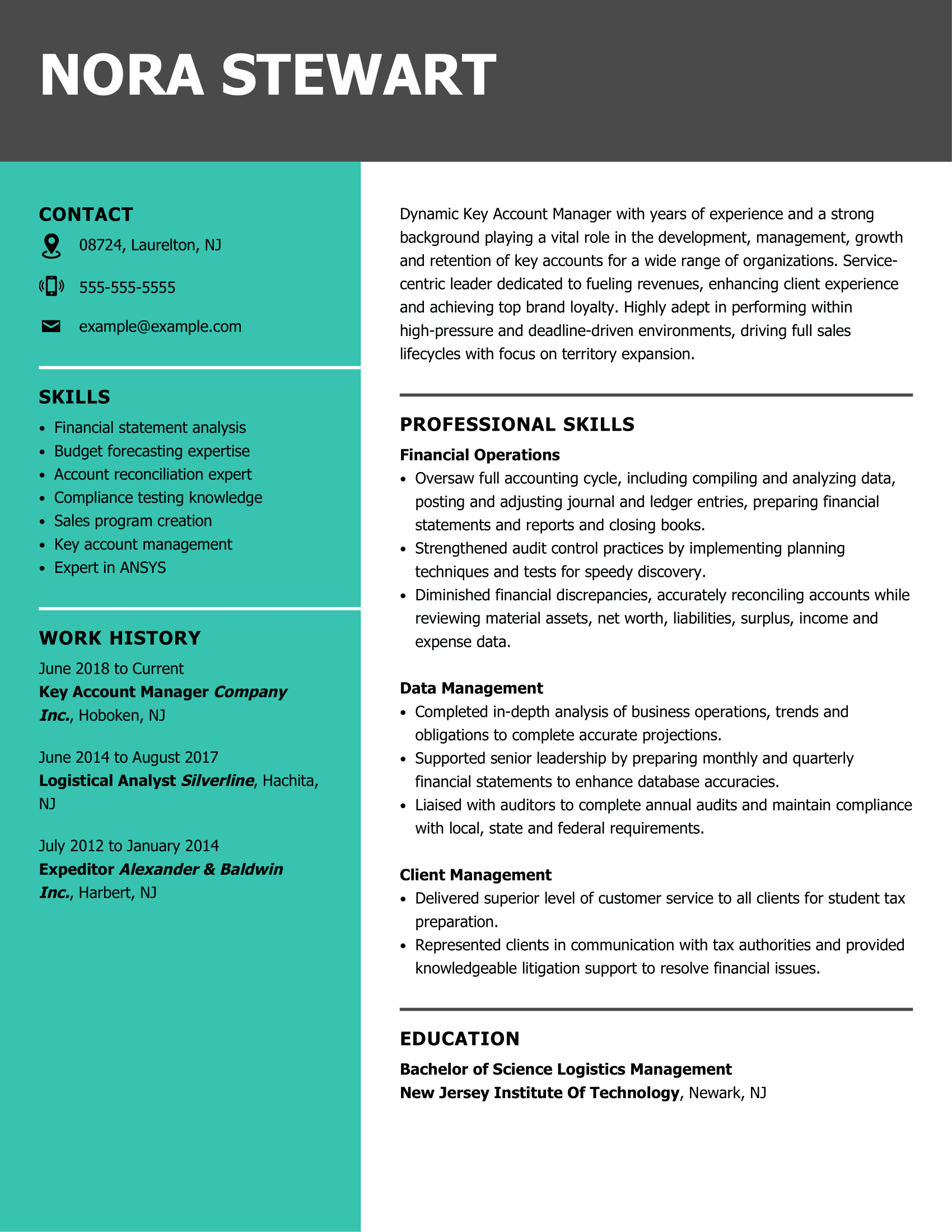

Key Account Manager Best Resume Examples Myperfectresume

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

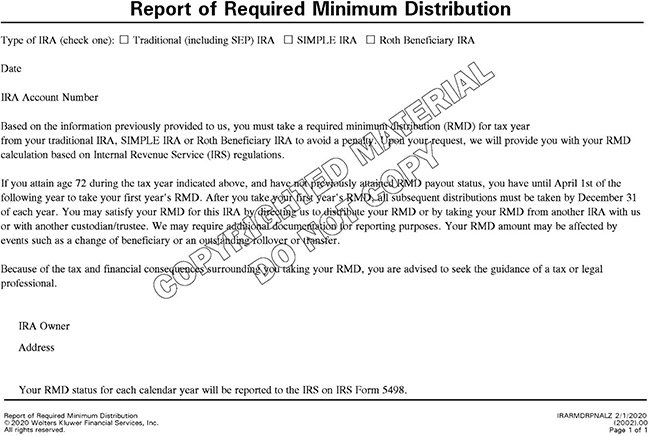

Individual Retirement Accounts Rmd Notice Deadline Approaching Wolters Kluwer

Tax Tip Don T Forget Subsequent Required Minimum Distributions Are Due Tas

How Much Should Accounting Cost For A New Limited Company

Individual Retirement Accounts Rmd Notice Deadline Approaching Wolters Kluwer

Why And How To Choose A Financial Year End Date Fastlane

How Much Should Accounting Cost For A New Limited Company

Year End Accounting For Limited Companies Made Simple

New Itr Filing Deadlines Form 16 Delayed Income Tax Filing Due Date Extended And More Mint

2021 401 K Deadlines For Plan Sponsors Guideline

Traders Should Consider Section 475 Election By The Tax Deadline

/ScreenShot2021-09-18at11.10.03AM-241ecfcb218d46bdbb4b16a285992b69.png)